EPAct Section 179 D

The Energy Policy Act of 2005 (“EPAct”) included Section 179D, which provides special tax incentives for qualified energy efficiency projects incorporated into non-residential buildings.

Section 179D directly supports two national priorities: Job Creation and Energy Independence. It has been extended four times, most recently in December of 2015, and is fully in force for the 2016 calendar year.

While hundreds of millions of dollars in tax credits have been claimed by businesses, contractors, architects and engineers from the 179D incentive program, very few who are entitled have participated.

Why?

Low Awareness

Complexity

Inertia

To benefit from Section 179D, The IRS requires that your project must be certified by a qualified expert. The experts must be multidisciplinary because the regulations are very complex.

Kilfinane Energy Consultants works directly with the preeminent legal, engineering and accounting firm in the field to ensure that our clients derive the maximum benefits from their lighting upgrade.

Kilfinane EnergyConsultants

Capital Efficient Lighting Solutions

Environmental Compliance

Rebate Counseling

Financing Available

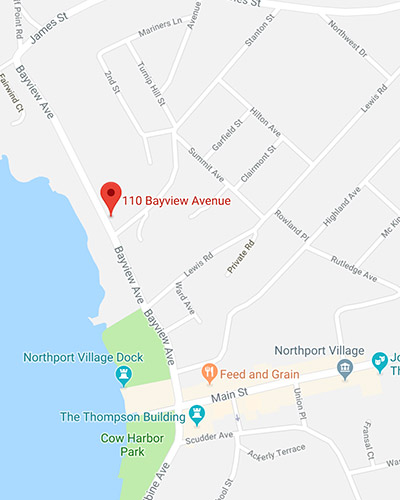

631.748.6885info@KilfinaneEnergy.com